FONDATION DE L’ACADÉMIE DE MÉDECINE

SENSIBILISER, PRÉVENIR, INNOVER POUR FAVORISER L’ACCÈS AU MEILLEUR DE LA SANTÉ

La Fondation de l’Académie de Médecine a pour mission de sensibiliser, prévenir et innover pour permettre à chacun d’être acteur de sa santé et de la protéger au mieux.

Elle fédère les experts et agit sur le terrain pour diffuser les connaissances et les bonnes pratiques en santé.

Elle encourage la philanthropie en abritant et soutenant des fondations partageant sa vision et ses valeurs.

Yves L’EPINE, Président de la Fondation de l’Académie de Médecine

Faire un don

Dons ponctuels ou réguliers, ciblés sur un ou plusieurs programmes, donations, legs… toutes les informations pour trouver le mode de soutien qui vous convient.

Créer sa fondation

Un projet philanthropique dans le domaine de la santé?

Nous vous accompagnons à toutes les étapes de la vie de votre fondation.

Nos actualités

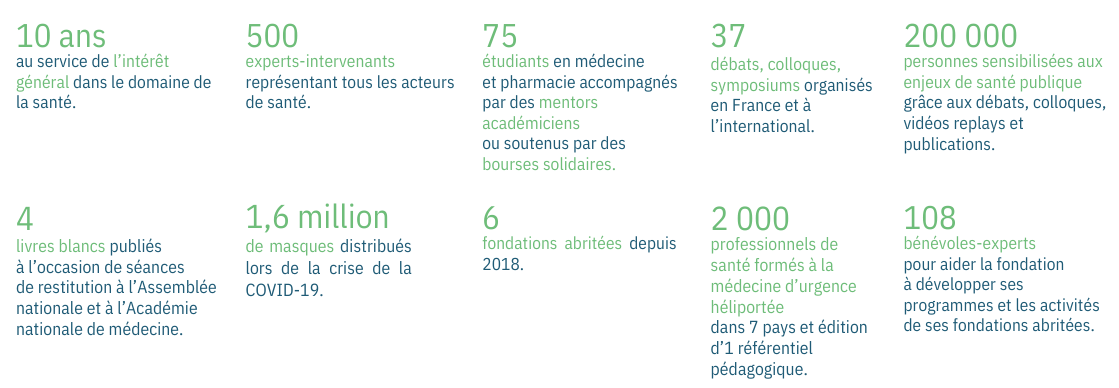

LA FONDATION EN CHIFFRES

Grand angle

Fondations abritées